📌 Key Takeaways

An invoice proves you paid someone to pump your grease trap—a manifest proves where that waste legally went and protects you during inspections.

- Manifests Document Chain of Custody: Manifests track who generated the waste, who transported it, and which authorized facility received it—creating the legal audit trail inspectors verify.

- Invoices Don’t Satisfy Houston Inspectors: Payment records show charges but can’t prove legal disposal, hauler licensing, or destination facility—the three elements compliance audits require.

- Generator Liability Extends Beyond Pump-Out: Even after the truck leaves, you remain responsible if waste reaches illegal dumps; manifests establish your due diligence.

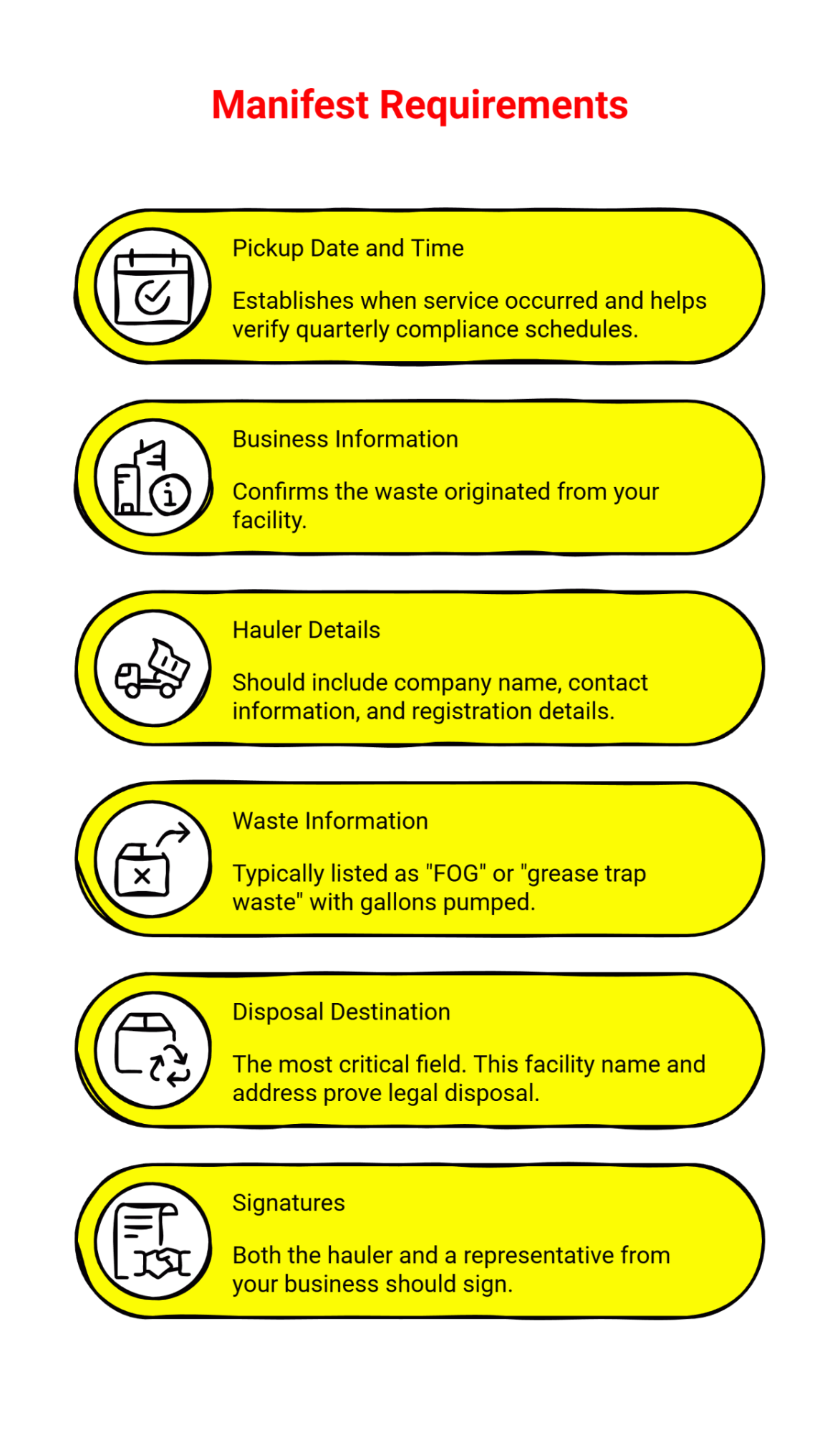

- Complete Manifests Include Six Critical Fields: Verify pickup date, your business name, hauler registration details, waste type/volume, disposal facility destination, and required signatures before approving payment.

- Documentation-First Payment Prevents Gaps: Implement the rule that no completed manifest means no payment authorization—this single checkpoint eliminates most compliance failures.

Missing manifests = invisible compliance gaps that surface during audits.

Restaurant operators managing grease trap compliance in Houston will gain immediate clarity on the documentation requirements that protect their business, preparing them for the practical implementation guidance that follows.

Grease Trap Compliance & Manifesting is the systematic documentation and reporting of liquid waste disposal to regulatory bodies, proving that waste was handled and disposed of legally. It’s like the receipt and tracking number for your taxes—it’s your only proof that you did everything right when the auditor comes knocking. Picture the relief of handing a health inspector a perfectly organized binder of waste manifests, silencing any questions about your operations immediately. To ensure this protection, you must ensure your service provider offers full electronic or physical manifesting with every pump-out.

Yet most restaurant owners don’t realize there’s a difference between the two documents they receive after a grease trap pump-out. An invoice proves you paid for the service. A manifest—sometimes called a trip ticket—proves where that waste actually went. That distinction becomes critical the moment a health inspector asks to see your records.

Think of it this way: the invoice is your credit card receipt, but the manifest is the shipping label plus delivery confirmation. One shows money changed hands. The other documents the complete chain of custody from your kitchen to an approved disposal facility. When an inspector arrives, they’re not trying to verify you spent money. They’re confirming your grease trap services followed proper waste handling protocols—and only a completed manifest can prove that.

Before you pay any hauler, require a completed manifest and file it in one accessible place. Your compliance binder becomes your invisible shield.

The 30-Second Answer: An Invoice Proves You Paid—A Manifest Proves Where the Waste Went

An invoice is a billing document. It itemizes charges, shows your payment, and helps with bookkeeping. A manifest is a legal tracking document that records who generated the waste, who transported it, and which facility received it for processing.

Here’s the practical difference: if your kitchen backs up and you call for emergency service, you’ll get an invoice showing you paid $450 for the pump-out. That’s proof of payment, nothing more. The manifest—which should accompany every service—includes your business name as the generator, the hauler’s registration details, the waste type and volume, and most importantly, the destination facility where your FOG (fats, oils, and grease) was legally disposed of.

Inspectors care about destinations. They need verification that waste reached an approved facility rather than an illegal dump site or storm drain. Clean is not compliant until it’s documented.

Why This Matters in Houston: The City Cares About Disposal, Not Just Pump-Out

Houston takes grease trap compliance seriously because improper disposal threatens public infrastructure and water quality. The city’s FOG program exists to prevent sewer backups and protect treatment facilities from damage caused by accumulated grease.

During routine inspections, health officials verify your maintenance schedule and check your documentation.² They’re confirming a complete chain of custody—that your waste was pumped, transported by a registered hauler, and delivered to a facility authorized to process it. An invoice doesn’t answer those questions.

This matters because liability doesn’t end when the truck leaves your property. If your hauler disposes of waste illegally, regulatory agencies can trace it back to your business as the generator.

A grease trap can run “fine” until it doesn’t—then the call becomes urgent, the paperwork becomes messy, and the site team scrambles. A predictable schedule and a consistent documentation workflow reduce that risk, especially when responsibility is shared across owners, general managers, and facilities leads.

For comprehensive information about liquid waste compliance solutions for the Houston area, restaurant operators should understand both the maintenance and documentation requirements that protect their business.

Invoice vs. Manifest: The Side-by-Side Comparison You Can Hand Your GM

| Aspect | Invoice | Manifest / Trip Ticket |

|---|---|---|

| What It Proves | Payment was made for service | Legal transport and disposal occurred |

| Key Fields Included | Service date, charges, payment terms, vendor contact | Generator info (your business), hauler/transporter info (including registration/ID numbers), waste type/volume, disposal facility, signatures |

| What It Doesn’t Prove | Where waste went or who handled it | How much you paid (separate billing) |

| What Inspectors Verify | Not typically requested during compliance audits | Chain of custody and destination facility |

| What To Do If You Only Have This | Request manifests immediately; don’t assume invoice = compliance | File chronologically; keep accessible for inspections |

This comparison reveals why paying the bill doesn’t keep you out of court; the manifest does.

What a Compliant Manifest Should Include (Check This Before You Pay)

Before you approve payment for any grease trap service, verify the manifest contains these essential fields:

Pickup date and time – Establishes when service occurred and helps verify quarterly compliance schedules.

Your business name and address (the generator) – Confirms the waste originated from your facility.

Hauler/transporter details – Should include company name, contact information, and any registration or ID fields (such as TCEQ registration number) proving they’re authorized to transport grease trap waste.³

Waste type and volume – Typically listed as “FOG” or “grease trap waste” with gallons pumped. This creates a disposal record matched to your trap capacity.

Disposal facility destination – The most critical field. This facility name and address prove legal disposal at an authorized location.

Signatures and verification – Both the hauler and a representative from your business should sign, creating legal accountability. Some manifests also include receiving facility confirmation.

If the disposal facility field is blank or lists only a generic “approved facility” without specifics, pause payment and request clarification. That’s your audit trail, and vague entries offer no protection during an inspection.

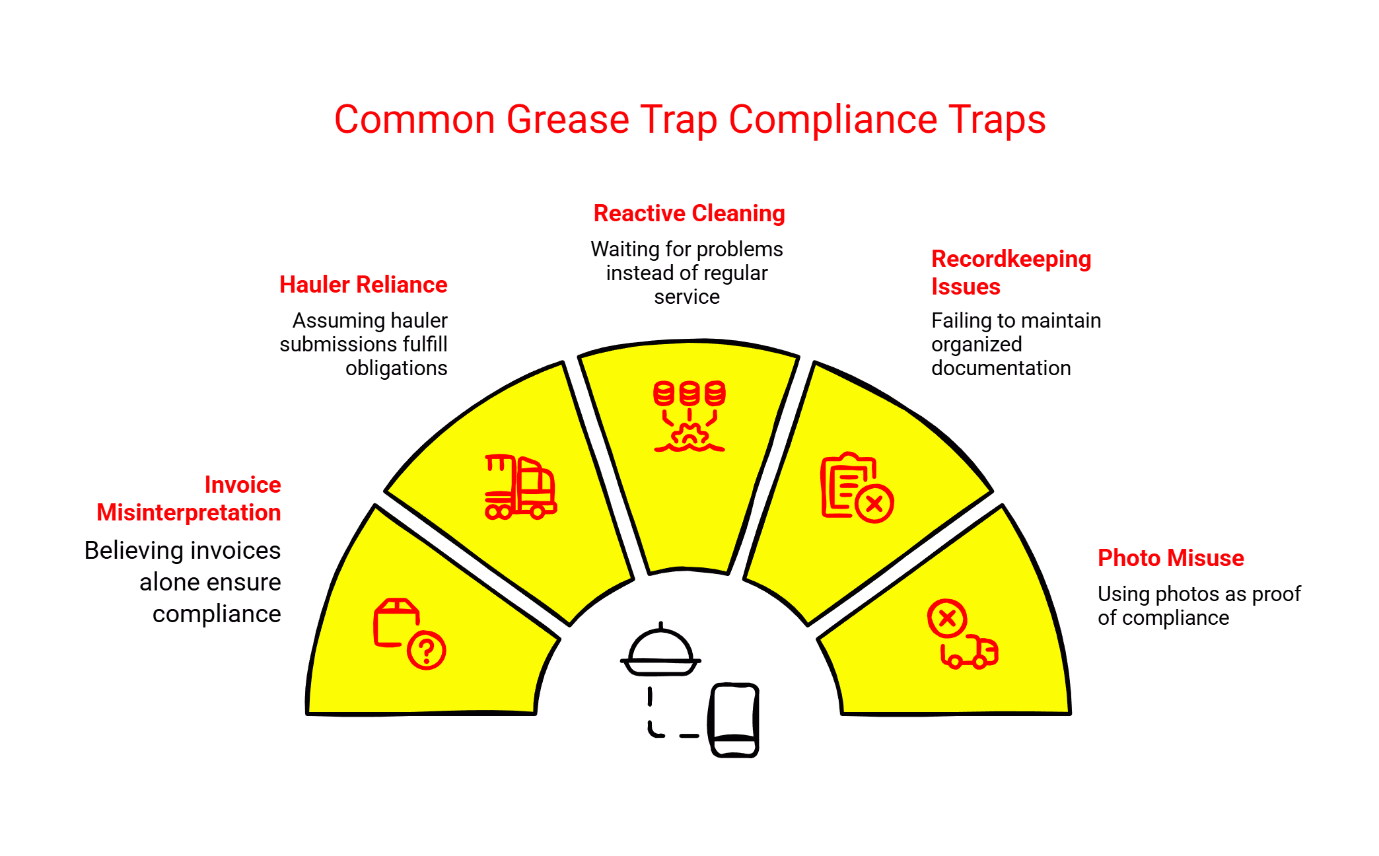

Common Traps: 5 Reasons Invoices Fail Audits

“I have an invoice, so I’m covered.” The invoice proves you paid someone to pump your trap. It doesn’t prove that person was licensed, that the waste went to a legal facility, or that the service even occurred. Inspectors dismiss invoices as compliance proof.

“The hauler said they filed it with the city.” Even if your hauler submits manifests to regulatory agencies, you’re still required to maintain your own copies. The generator—that’s you—bears ultimate responsibility for documentation.

“We only clean when it smells or backs up.” Relying on reactive service typically violates Houston’s standard quarterly cleaning requirement for commercial grease traps. Unless you have an approved waiver, waiting for problems means you’re likely already out of compliance. Missing manifests from skipped quarters create documentation gaps that inspectors flag immediately.

“I can’t find last quarter’s paperwork.” Disorganized recordkeeping is the fastest way to fail an inspection. When you can’t produce manifests on request, inspectors assume non-compliance even if service occurred.

“A photo of the truck is enough.” Photos prove a vehicle visited your property. They don’t prove legal disposal, proper licensing, or waste destination—the three things inspectors actually care about.

For restaurant managers unfamiliar with Houston’s requirements, our plain-English guide to the Houston FOG ordinance breaks down the compliance framework in operationally practical terms.

A Simple System That Works: The Compliance Binder (Or Shared Folder) in 15 Minutes

Set up a physical three-ring binder or shared digital folder dedicated solely to grease trap compliance. This becomes your single source of truth during inspections.

Create four tabs or folders: Five-Year Manifest Archive, Current Year Manifests, Service Invoices (for accounting), Equipment Information, and Vendor Contacts. File each completed manifest chronologically in the Current Year tab immediately after service. (Note: Houston requires keeping 5 years of manifests on-site). Don’t mix manifests with invoices—keep proof of legal disposal separate and prominent.

Assign ownership to your general manager or facilities lead. Make it their responsibility to verify the hauler provides a completed manifest before releasing payment. This one accountability checkpoint prevents documentation gaps.

Store the binder on-site in a location your opening manager knows about—typically the manager’s office or a locked file cabinet near your grease trap access point. Keep a digital backup in cloud storage so you can retrieve copies if the physical binder is misplaced or damaged.

Important note on retention: Documentation retention requirements can vary by program and jurisdiction. Consult current City of Houston[¹] and Texas guidance[³] and confirm current expectations through official sources to ensure you’re meeting applicable retention periods.

When inspectors arrive, you hand them the binder within 60 seconds. That’s the operational standard that prevents compliance anxiety.

Vendor Checklist: What to Ask Your Grease Trap Hauler

Before signing any service agreement, ask these questions. The answers reveal whether a hauler prioritizes documentation or cuts corners:

“Will you provide a completed manifest with every pump-out?” The only acceptable answer is yes, with either electronic delivery or a physical copy left on-site immediately after service.

“Which disposal facility do you use?” They should name a specific facility by name and location. Vague responses like “an approved site” or “multiple locations depending on the day” suggest inconsistent practices.

“Can you re-send manifests if we need copies for an audit?” Professional haulers maintain organized records and can quickly provide duplicate manifests. Reluctance or confusion about this request is a red flag.

“Who signs the manifest and when?” Both the hauler and your representative should sign before the truck leaves. If they say manifests are “completed later” or “filed from the office,” you’re relying on paperwork that may never materialize.

“What’s your TCEQ registration number?” Licensed haulers can provide this immediately. If they hesitate or claim it’s “not required for this type of work,” walk away.

Red flags include vague answers about where waste goes, inconsistent paperwork formats, or claims that manifests “aren’t necessary.” These warning signs indicate a hauler who may expose your business to compliance risk.

Understanding these vendor selection criteria helps prevent the FOG violation myths that can cost Houston restaurants thousands in fines and operational disruptions.

If You Only Have Invoices Right Now: What to Do Next

Don’t panic, but do act quickly. Contact your current hauler immediately and request copies of all manifests for the past year. Explain you need them for compliance documentation. If they can provide them, file them properly and continue forward with a documentation-first approach.

If your hauler can’t produce manifests—or never created them—you have a serious problem. Switch to a documentation-forward provider immediately. The cost difference between a proper service and a cheap pump-out is negligible compared to the fines and legal exposure from missing manifests.

Going forward, implement the payment-after-manifest rule: no completed manifest, no payment authorization. This policy change protects you and signals to haulers that you take compliance seriously.

Schedule your next service with a provider who understands that proper commercial grease trap cleaning in Houston includes documentation as part of the service, not an optional add-on.

Frequently Asked Questions

Is a grease trap invoice enough for a City of Houston inspection?

No. Invoices prove payment but don’t document legal disposal. Inspectors require manifests showing chain of custody and destination facility. Use official guidance for current expectations.²

What is a grease trap manifest (or trip ticket)?

A manifest is a legal tracking document that records who generated the waste, who transported it, and which authorized facility received it for disposal. It creates an audit trail proving compliance with waste handling regulations.³

Who keeps the manifest—the restaurant or the hauler?

Both. The hauler maintains copies for their records and regulatory reporting. You, as the generator, are legally required to maintain your own copies for inspection purposes. The operationally safe approach is to keep a retrievable copy in an on-site binder or shared folder so it can be produced quickly when requested.²

Where should I store manifests so a manager can find them fast?

Keep them in a dedicated compliance binder stored on-site in a consistent location—typically the manager’s office or near your equipment access point. Your opening manager should know exactly where it is.

How long should I keep manifests?

Retention expectations can vary by jurisdiction and regulatory program. Confirm current requirements using official City of Houston[¹] and Texas guidance[³] and keep records according to those requirements.

For restaurant operators ready to implement a documentation-first maintenance program, contact Drane Ranger at 281-489-1765 (Monday through Friday, 9am until 6pm) or email rwoods3719@aol.com. Serving Houston since 1985, we provide the systematic compliance documentation that turns anxiety into peace of mind.

You can also reach us through our contact page.

References

[¹] City of Houston (official site): https://www.houstontx.gov/

[²] Houston Health Department – Waste Generator Documentation: https://www.houstonhealth.org/media/271/download

[³] Texas Commission on Environmental Quality – Grease Trap Waste Guidance (RG-389): https://www.tceq.texas.gov/downloads/assistance/publications/rg-389.pdf/@@download/file/rg-389.pdf

[⁴] Better Business Bureau Profile (Drane Ranger): https://www.bbb.org/us/tx/houston/profile/septic-tank-cleaning/drane-ranger-vacuum-service-0915-31003989

Disclaimer: This article is for informational purposes only and does not constitute legal advice. For guidance specific to your restaurant, consult applicable City of Houston requirements and qualified professionals on your obligations.

Our Editorial Process

Our expert team uses AI tools to help organize and structure our research, but every article is ultimately reviewed and refined by subject matter experts and experienced humans on our Insights Team to ensure accuracy and clarity.

About the Drane Ranger Insights Team

The Drane Ranger Insights Team is our dedicated engine for synthesizing complex topics into clear, helpful guides. While our content is thoroughly reviewed for clarity and accuracy, it is for informational purposes and should not replace professional advice.