📌 Key Takeaways

Emergency Failures Cost 5-10x More Than Scheduled Maintenance: A single grease trap emergency during peak hours can trigger lost revenue, health department fines, environmental cleanup costs, and reputation damage that far exceeds quarterly maintenance expenses, making prevention the clear financial winner.

The “Fix When Broken” Mindset Ignores Hidden Revenue Losses: Emergency grease trap failures typically occur during dinner rush, forcing service suspension when revenue per hour is highest, creating cascading losses from cancelled reservations, disappointed customers, and staff sent home early.

Cost-Benefit Framework Transforms Budget Conversations: Present ownership with a visual spreadsheet comparing predictable quarterly maintenance costs against itemized emergency incident expenses (lost peak-hour revenue, health department fines, cleanup costs) to shift the discussion from “operational expense” to “profit protection strategy.”

Documentation Builds Your Strategic Credibility: Track maintenance completion, compliance records, and absence of emergency incidents throughout the year to demonstrate both operational expertise and financial responsibility, positioning yourself for broader management roles with P&L oversight.

Compromise Strategy for Resistant Ownership: When facing budget pushback, propose a quarterly emergency fund designated specifically for grease trap issues, covering both maintenance and repairs while giving ownership budget control and creating data for next year’s more compelling maintenance argument.

This framework transforms you from someone defending expenses into a strategic manager who protects profitability through data-driven decisions, while the specific cost calculations and documentation processes provide the tools needed for successful ownership presentations.

The monthly budget meeting is approaching, and there’s that line item again—grease trap maintenance. Your owner’s eyebrows raise, and you can practically hear the question forming: “Why are we paying for this every month when nothing’s broken?”

This conversation happens in restaurants across Houston every quarter. Operations managers know preventative maintenance prevents disasters, but convincing cost-focused ownership requires more than operational intuition. You need data, frameworks, and a clear financial argument that speaks their language.

The framework below transforms this challenging conversation into a strategic win. Rather than defending an expense, you’ll be presenting an investment strategy that protects revenue and demonstrates your financial acumen.

The Conversation Every Manager Dreads: “Why Are We Paying for This Every Month?”

Restaurant ownership thinks in profit margins and immediate returns. A recurring maintenance charge feels like money disappearing without visible benefit—until something goes catastrophically wrong.

This mindset creates an impossible position for operations managers. You’re responsible for preventing disasters that ownership hasn’t experienced yet. The challenge isn’t just operational; it’s psychological. How do you justify spending money to prevent problems that feel theoretical?

The key lies in reframing the conversation. Instead of asking ownership to trust your operational judgment, present them with financial data that shows maintenance as profit protection. This shift moves the discussion from “operational necessity” to “business strategy.”

Business Impact Scheduled maintenance protects three critical revenue streams: daily sales continuity, compliance-based operating licenses, and long-term brand reputation. A single grease trap failure can impact all three simultaneously, creating compounding financial losses that far exceed maintenance costs.

Handling the #1 Objection: “It’s Cheaper to Just Fix it if it Breaks”

This objection sounds financially prudent but ignores the hidden cost structure of emergency failures. The repair bill represents only a fraction of the total financial impact.

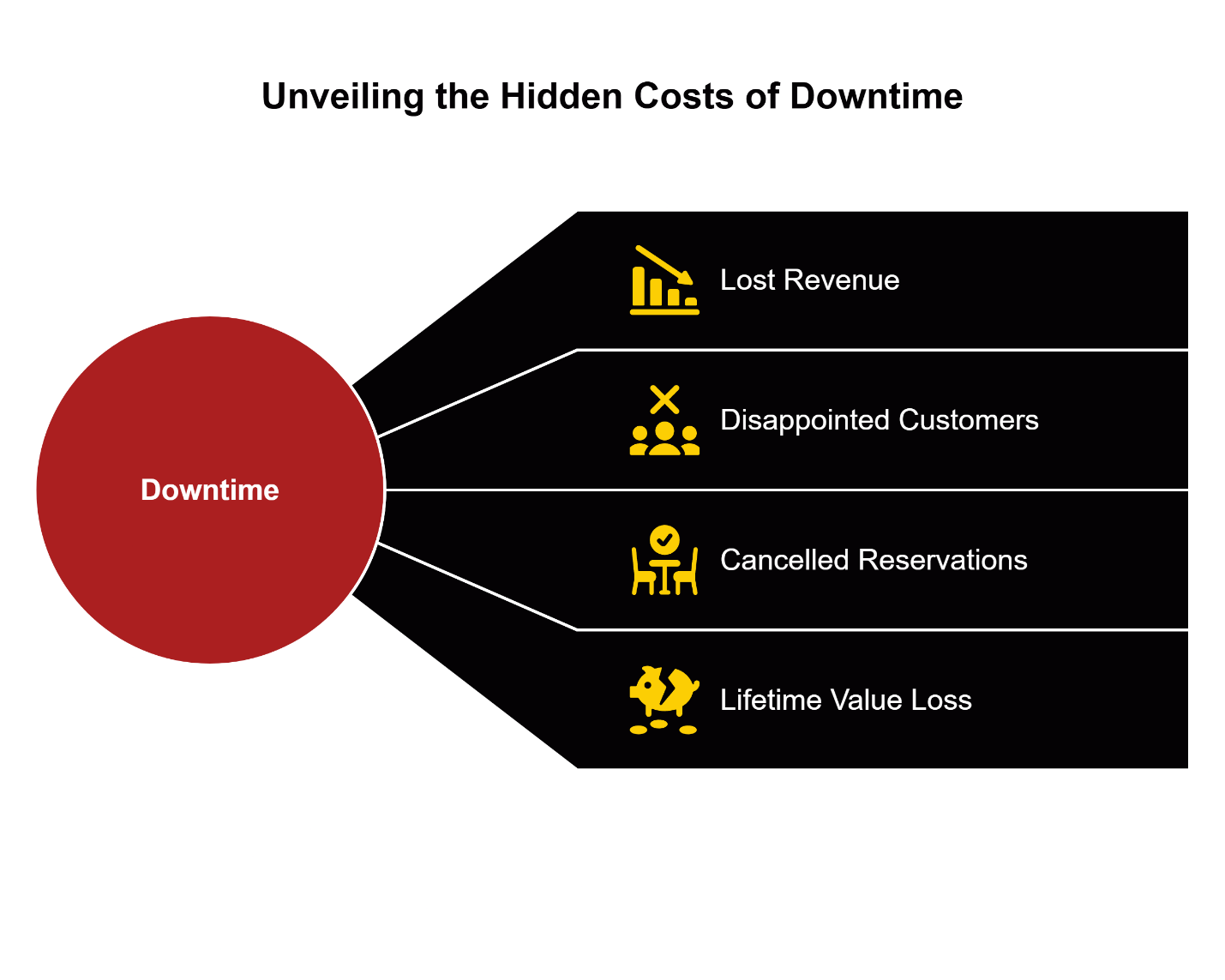

Emergency grease trap failures don’t happen during convenient business hours. They typically occur during peak service periods, creating cascading operational disruptions that multiply costs exponentially.

The True Cost of Downtime: Quantifying Lost Revenue

A backed-up grease trap during dinner rush doesn’t just require repair—it can force partial or complete service suspension. To calculate potential impact, consider your restaurant’s peak-hour revenue and estimate how many hours of service disruption an emergency might cause.

For example, if your establishment generates significant evening revenue, even a few hours of disrupted service during peak periods represents substantial lost sales. This calculation excludes the ripple effects: disappointed customers, cancelled reservations, and staff sent home without full shifts.

The downstream impacts extend beyond immediate revenue loss. Customers who experience service disruptions during special occasions or business dinners often don’t return, representing lifetime value losses that can accumulate over time.

Beyond the Repair Bill: Fines, Cleanup, and Reputation Damage

Houston’s health department doesn’t pause enforcement for operational emergencies. A grease trap overflow can trigger immediate violations, with fines that vary based on severity and repeat occurrences.

Technical Note Restaurant operators should verify current Houston grease trap maintenance requirements and associated penalties with local health authorities, as regulations and enforcement procedures can change. Maintaining proper documentation during routine inspections helps demonstrate compliance efforts.

Environmental cleanup adds another cost layer. Professional remediation services typically charge premium rates for emergency response, with costs varying based on the affected area and contamination severity.

The reputation damage proves hardest to quantify but potentially most costly. Social media amplifies service disruptions, with negative reviews highlighting unsanitary conditions spreading far beyond the immediate customer base. Recovery from reputation damage requires sustained effort and consistent positive experiences.

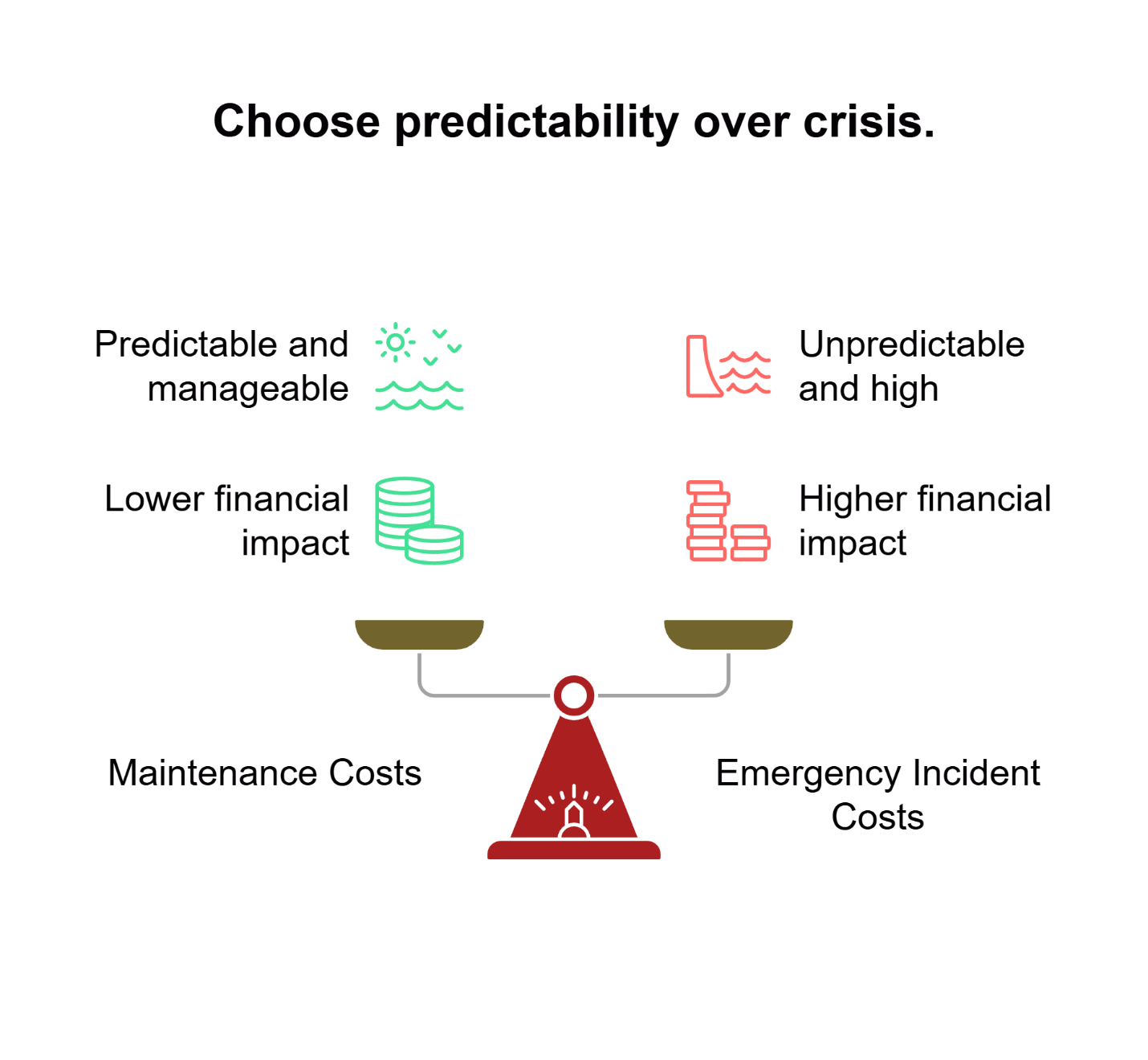

The Tool That Wins the Argument: A Simple Cost-Benefit Framework

The most effective approach for ownership conversations involves presenting a clear, visual comparison between predictable maintenance costs and estimated emergency incident costs. This framework provides the data-driven foundation ownership needs to approve recurring maintenance budgets.

Day-to-Day Application Create a simple spreadsheet comparing your quarterly maintenance cost against the itemized costs of a single emergency incident. Include lost revenue calculations based on your specific peak hour averages, research local health department fine schedules, and obtain cleanup cost estimates from area remediation services.

The framework works because it transforms abstract risk into concrete financial projections. Instead of asking ownership to imagine potential problems, you’re showing them calculated financial exposure compared to known prevention costs.

According to the DraneRanger.com framework, the cost differential between scheduled maintenance and emergency response creates compelling business justification when factoring in all direct and indirect expenses. Research your specific costs to build an accurate comparison for your situation.

This cost-benefit analysis becomes your negotiation tool. Print the comparison, bring it to budget meetings, and reference specific line items when ownership questions maintenance expenses. The visual impact of seeing prevention costs versus comprehensive emergency costs creates immediate clarity about the financial logic.

Most importantly, this framework positions you as a strategic thinker who protects profitability through data-driven decision making. Ownership begins seeing maintenance not as operational overhead but as insurance with measurable returns.

What If…? Planning for Ownership Rejecting the Proposal

Even with compelling data, some ownership groups remain resistant to recurring expenses. This resistance often stems from cash flow concerns or past experiences with unreliable service providers rather than disagreement with the underlying logic.

Prepare for this scenario by developing a compromise proposal that demonstrates flexibility while maintaining operational protection. First, acknowledge their budget constraints as legitimate business concerns. This validation prevents the conversation from becoming adversarial.

Present a modified approach: quarterly emergency fund allocation specifically designated for grease trap issues. This fund covers both emergency repairs and scheduled maintenance, giving ownership budget control while ensuring resources exist for system protection.

If they accept this compromise, track every expense against the fund throughout the year. Document maintenance costs, emergency calls, and any related incidents. This data becomes the foundation for next year’s conversation, typically demonstrating that scheduled maintenance represents a smaller investment while preventing larger expenses.

From Cost Center to Value Driver: Securing Your Maintenance Budget

Successfully securing maintenance approval demonstrates your ability to think beyond daily operations toward long-term business protection. This achievement positions you as someone who understands both operational requirements and financial responsibility.

Frame the approved maintenance plan as a business process improvement rather than just problem prevention. Scheduled maintenance creates predictable budgeting, reduces emergency disruptions, and maintains consistent grease trap service standards that support health code compliance.

Document the results throughout the year. Track maintenance completion, compliance records, and absence of emergency incidents. This documentation supports budget requests for other preventative maintenance areas, establishing your credibility for future operational investments.

The skills developed through this process—financial justification, risk assessment, and stakeholder communication—prepare you for broader management responsibilities. As restaurants expand or consolidate operations, managers who demonstrate both operational expertise and financial acumen become candidates for regional oversight roles with greater P&L responsibility across multiple locations.

Ready to build your cost-benefit framework? Contact DraneRanger.com to request your quote for scheduled grease trap cleaning services and receive the supporting documentation you need for your ownership presentation.